The Mystery of 21 Million Bitcoin: Why and How It Was Decided

Bitcoin, the world’s first decentralized cryptocurrency, has a unique design feature that sets it apart from traditional currencies: its total supply is capped at 21 million BTC. This scarcity has played a significant role in its value proposition as "digital gold." But why exactly did Satoshi Nakamoto, Bitcoin's mysterious creator, choose this specific number? And how does this finite supply work in practice? Let’s delve into the "why" and "how" of Bitcoin’s 21 million cap.

Why 21 Million Bitcoin?

Satoshi Nakamoto never explicitly explained why the total supply was set at 21 million BTC. However, there are several plausible theories that offer insight into this choice.

- Scarcity and Economic Philosophy

Satoshi designed Bitcoin as a deflationary asset, contrasting sharply with traditional fiat currencies that can be printed at will by central banks. By capping the supply at 21 million, Bitcoin mimics the scarcity of precious metals like gold, making it an attractive store of value. This fixed supply ensures that Bitcoin remains resistant to inflation, aligning with Satoshi's vision of creating "sound money."

- Mathematical Elegance

The 21 million cap is a product of Bitcoin's block reward system, which halves approximately every four years. The initial reward for mining a block was 50 BTC, and this reward is halved every 210,000 blocks. The halving schedule creates a geometric series, with the total supply converging to 21 million BTC. This number arises naturally from the protocol's design rather than being arbitrarily chosen.

- Global Relevance

Some suggest that the 21 million cap was designed to align with the global economy. If Bitcoin were to become a universal currency, dividing 21 million BTC among the global population ensures meaningful divisibility. Bitcoin’s smallest unit, the satoshi (0.00000001 BTC), allows for microtransactions even with a capped supply.

- Psychological Impact

A finite supply fosters a strong narrative of scarcity, increasing Bitcoin’s perceived value. By limiting the total supply, Bitcoin creates a sense of exclusivity, attracting early adopters and long-term investors.

How Bitcoin’s 21 Million Cap Works

The mechanism behind Bitcoin's fixed supply lies in its block reward system and its halving schedule. Here’s how it works:

- The Block Reward

When Bitcoin was launched in 2009, miners received 50 BTC as a reward for validating each block of transactions. Every 210,000 blocks (roughly every 4 years), the block reward is halved. This process is known as a halving event.

- The Halving Formula

The block reward for a given halving is calculated as:

Block Reward= 50 / (2^n)

- Finite Halvings: Why Only 33?

Bitcoin can only undergo 33 halving events before the block reward becomes smaller than 1 satoshi (0.00000001 BTC), which is Bitcoin’s smallest divisible unit. After the 33rd halving, the block reward effectively becomes 0 BTC, and no new Bitcoin will be minted. This final halving is expected to occur around the year 2140.

- Total Supply Calculation

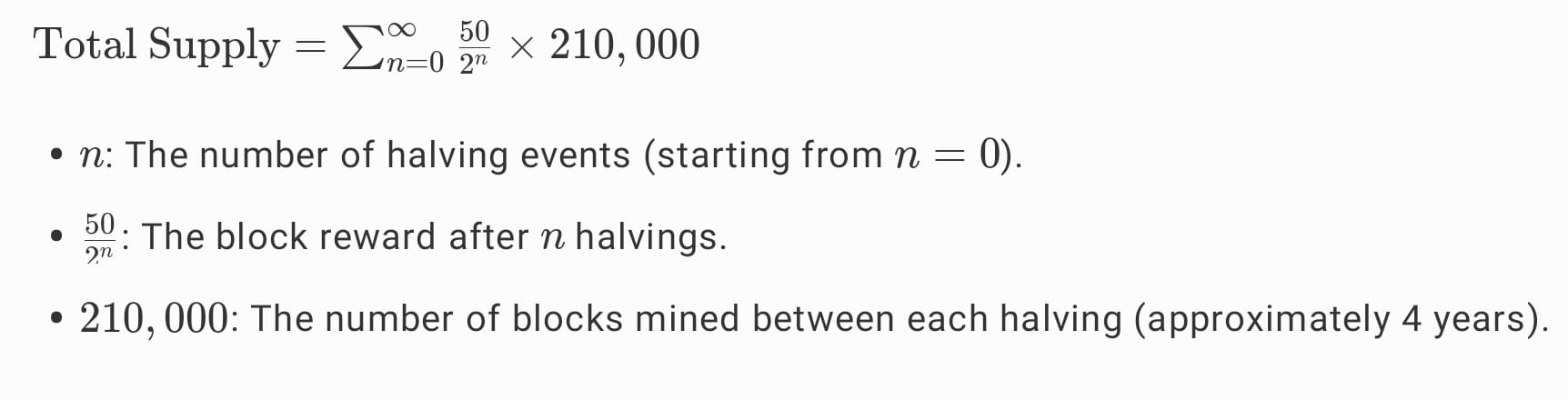

The total Bitcoin supply is the sum of all block rewards over these 33 halvings It can be expressed as:

The Economic Implications of 21 Million Bitcoin

- Transition to Transaction Fees

As the block reward diminishes, miners will rely entirely on transaction fees for revenue. This transition ensures that the Bitcoin network remains secure and sustainable even after the 21 million cap is reached.

- Store of Value

The fixed supply of Bitcoin enhances its utility as a store of value, similar to gold. With no possibility of inflation, Bitcoin's scarcity contributes to its appeal as a hedge against fiat currency devaluation.

- Global Divisibility

Although 21 million BTC might seem like a small number, Bitcoin’s divisibility into 100 million satoshis ensures that even minute fractions of BTC can be used for everyday transactions. This design makes Bitcoin practical for global adoption.

Why the 21 Million Cap Matters

Bitcoin’s scarcity is one of its most powerful features, distinguishing it from inflation-prone fiat currencies. By capping the supply at 21 million BTC, Satoshi Nakamoto ensured that Bitcoin would remain a deflationary, valuable, and scarce asset for generations to come. The halving mechanism and the mathematical elegance behind the total supply reflect a meticulous design aimed at creating a long-lasting and stable currency.

While we may never know the exact reasoning behind the choice of 21 million BTC, the interplay of economic principles, mathematical design, and psychological factors makes this number both practical and profound.

Conclusion

The 21 million BTC cap is more than just a number—it’s a cornerstone of Bitcoin’s value proposition. Whether it was chosen for its mathematical elegance, alignment with global monetary metrics, or psychological appeal, the cap ensures Bitcoin’s scarcity, resilience, and relevance in the evolving financial landscape. As Bitcoin continues to gain traction, its finite supply will remain a key driver of its enduring appeal and value.